Top 10 Steel-Producing Countries in the World (Excluding China & Russia) – Updated September 2025

Posted on 18 September 2025

Top 10 Steel-Producing Countries in the World (Excluding China & Russia) – September 2025 Update

Steel remains the cornerstone of global industrialization, infrastructure, and trade. From skyscrapers and bridges to vehicles and renewable energy systems, steel is everywhere. While China and Russia dominate the news in terms of output, it is equally important to look at the other leading nations shaping global steel production.

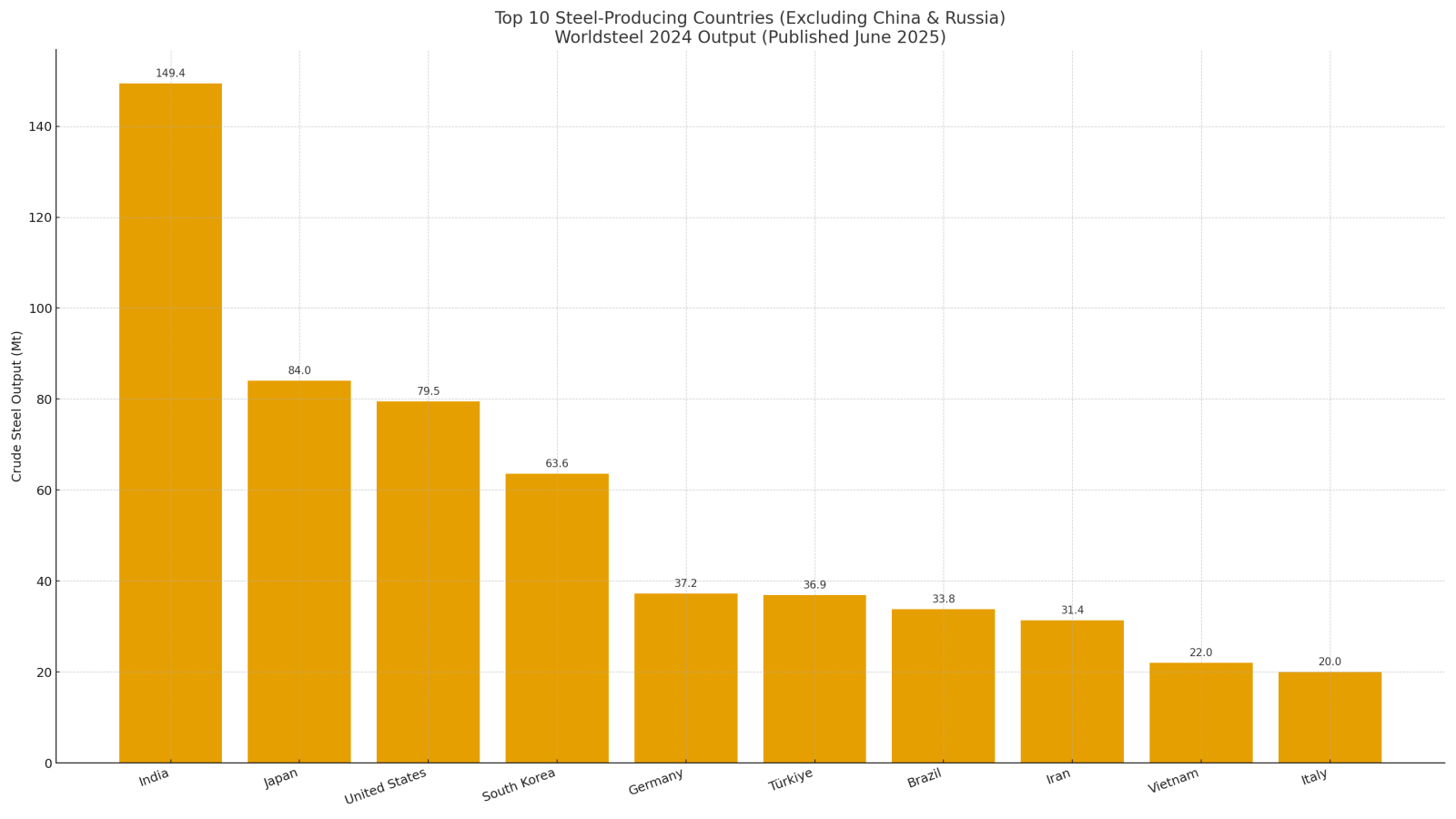

As of September 2025, using the latest authoritative data from the World Steel Association’s World Steel in Figures 2025 (covering 2024 production), these are the Top 10 crude-steel–producing countries, excluding China and Russia. Together, they represent the backbone of steel innovation, regional supply, and international trade flows.

This article dives deeper into each nation’s steel industry, analyzing not only production numbers but also domestic drivers, export markets, policy influences, and sustainability trends.

1. India (~149.4 Mt in 2024)

India is the largest steel producer outside China, with nearly 149.4 million tonnes of crude steel produced in 2024. The country has set ambitious goals of reaching 300 Mt by 2030–31, driven by enormous domestic demand and infrastructure expansion.

-

Domestic Drivers: Rapid urbanization, housing projects, industrial corridors, and government-backed infrastructure initiatives like roads, railways, and renewable energy facilities.

-

Exports: India is increasingly targeting Southeast Asia and the Middle East, balancing its growing domestic consumption with export competitiveness.

-

Policy & Strategy: India has imposed duties on certain steel imports to protect local mills and ensure fair competition. Simultaneously, the government promotes value-added steel production, such as high-strength rails and automotive-grade sheets.

-

Green Transition: Indian mills are experimenting with hydrogen-based steelmaking and carbon-capture technologies, though coal-based blast furnaces still dominate.

India’s growth trajectory ensures that it will remain a pivotal player in global steel, especially as multinational investors eye India as a manufacturing hub.

2. Japan (~84.0 Mt)

Japan produced 84.0 Mt of steel in 2024, ranking second among non-China/Russia producers. Despite an aging domestic market, Japan’s steel sector is renowned for technological sophistication and high-grade output, particularly for automotive, shipbuilding, and electronics.

-

Industry Focus: Japan’s major companies (Nippon Steel, JFE, Kobe Steel) lead in producing Advanced High-Strength Steels (AHSS), electrical steels, and stainless products.

-

Exports: Japan is a major steel exporter across Asia, supplying Southeast Asia, India, and South Korea with specialized products.

-

Sustainability Path: Japan is pioneering hydrogen-based Direct Reduced Iron (DRI) and Carbon Capture, Utilization, and Storage (CCUS) to cut emissions from its blast furnaces.

-

Challenges: Domestic steel demand is limited by demographic decline and slower construction, making exports and high-value steel the core strategy.

Japan’s role is less about sheer volume and more about quality, innovation, and sustainability leadership.

3. United States (~79.5 Mt)

The U.S. produced 79.5 Mt of crude steel in 2024, powered mainly by its Electric Arc Furnace (EAF) capacity, which accounts for over 70% of production. This makes the U.S. one of the most scrap-efficient and flexible steel markets in the world.

-

Domestic Demand: Driven by non-residential construction, oil & gas infrastructure, machinery, and automobiles.

-

Policy Influence: “Buy America” clauses, federal infrastructure spending, and Section 232 tariffs continue to shape the domestic market and import dynamics.

-

EAF Advantage: With abundant scrap availability, U.S. producers can adjust capacity faster than traditional blast furnaces. Leading companies like Nucor, Steel Dynamics, and Cleveland-Cliffs dominate flat-rolled and long products.

-

Sustainability: The U.S. already has one of the lowest CO₂ intensities globally thanks to EAF reliance. However, challenges remain in decarbonizing flat-rolled output and sourcing high-grade metallics (HBI, DRI).

The U.S. is increasingly positioning itself as a green steel leader through technology, recycling, and government policy support.

4. South Korea (~63.6 Mt)

South Korea produced 63.6 Mt of crude steel in 2024, largely driven by POSCO and Hyundai Steel, two globally influential companies.

-

Strengths: Korea specializes in automotive-grade steels, shipbuilding plates, and high-strength structural products.

-

Export Dependence: Steel exports represent a significant portion of Korea’s industrial output, with shipments across Asia, the Middle East, and Europe.

-

Innovation: Korea is investing heavily in AHSS, electrical steel for EVs, and hydrogen-based steelmaking pilots.

-

Risks: Korea’s exposure to global trade cycles makes it vulnerable to downturns in shipbuilding, autos, or construction.

South Korea’s steel sector combines technological edge with export reliance, making it a bellwether for global demand.

5. Germany (~37.2 Mt)

Germany produced 37.2 Mt in 2024, making it the largest producer in the European Union.

-

Product Mix: Specializes in flat products for automobiles, engineering, and machinery.

-

Decarbonization Leadership: German mills are at the forefront of Europe’s green steel push, converting blast furnaces to hydrogen-ready DRI and EAF hybrids.

-

EU Policy Impact: Germany faces high energy costs and strict carbon pricing under the EU Emissions Trading System (ETS) and Carbon Border Adjustment Mechanism (CBAM).

-

Demand Linkages: Output is closely tied to the health of the German auto sector and broader EU manufacturing.

Germany is less about volume and more about innovation, sustainability, and regulatory alignment with the EU’s net-zero goals.

6. Türkiye (~36.9 Mt)

Türkiye produced 36.9 Mt of crude steel in 2024, almost entirely via EAF technology. This makes it one of the world’s largest scrap importers.

-

Exports: Türkiye is a major supplier of rebar and long products to the EU, Middle East, and North Africa.

-

Domestic Market: Demand is driven by construction and earthquake-related rebuilding programs.

-

Trade Pressures: EU trade defenses and safeguard measures often restrict Turkish exports, forcing diversification.

-

Sustainability Outlook: The industry is exploring DRI/EAF hybrids and better scrap collection systems to cut emissions.

Türkiye plays a critical role in regional steel trade flows and scrap markets.

7. Brazil (~33.8 Mt)

Brazil produced 33.8 Mt in 2024, anchored by integrated mills with strong slab capacity.

-

Export Hub: Brazil is a top exporter of semi-finished steel (slabs), supplying the U.S., Europe, and Latin America.

-

Domestic Drivers: Construction, appliances, and automobile production support local demand.

-

Resource Advantage: With abundant iron ore and renewable energy, Brazil has natural potential for green steel leadership.

-

Challenges: Logistics, currency volatility, and regulatory changes can impact competitiveness.

Brazil’s exports make it a strategic link in the Americas’ steel chain.

8. Iran (~31.4 Mt)

Iran produced 31.4 Mt in 2024, relying on Direct Reduced Iron (DRI) plus EAF routes, thanks to its natural gas reserves.

-

Domestic Market: Steel demand is tied to construction and infrastructure spending.

-

Exports: Despite sanctions, Iran exports billets and long products to the Middle East, Asia, and occasionally Africa.

-

Constraints: Energy shortages, sanctions, and trade restrictions limit Iran’s ability to expand exports globally.

Iran is a regional steel power, balancing domestic development with limited but persistent export activity.

9. Vietnam (~22.0 Mt)

Vietnam produced 22.0 Mt in 2024, reflecting its rapid industrial rise in Southeast Asia.

-

Growth Drivers: Massive domestic demand for housing, infrastructure, and FDI-driven manufacturing (electronics, machinery).

-

Exports: Vietnam exports HRC and semi-finished products within ASEAN and to global markets, while still importing high-grade steels.

-

Strategic Role: Vietnam is a rising regional hub, attracting foreign investment and capacity expansions.

Vietnam’s steel industry is young, fast-growing, and export-oriented, making it one to watch in Asia.

10. Italy (~20.0 Mt)

Italy produced 20.0 Mt in 2024, ranking second in the EU after Germany.

-

Production Base: Predominantly EAF-driven, focused on rebar, longs, and specialty products.

-

Regional Integration: Italy’s mills are closely tied to EU demand, construction cycles, and scrap flows.

-

Sustainability Path: Italian producers are investing in low-carbon EAF upgrades and EU-backed decarbonization funding.

Italy is a Mediterranean steel hub, balancing domestic needs and EU-wide integration.

Global Trends and Outlook

Looking across these top 10 nations, several themes emerge:

-

Shift Toward EAF and Scrap – Countries like the U.S., Türkiye, and Italy are heavily scrap-based, giving them lower carbon footprints.

-

Green Steel Race – Germany, Japan, South Korea, and India are testing hydrogen-DRI, CCUS, and other clean technologies.

-

Trade Tensions – EU safeguard measures, U.S. Section 232 tariffs, and Asian trade flows continue to reshape export opportunities.

-

Regional Growth Engines – India and Vietnam stand out as growth leaders, while Germany and Japan focus on innovation and sustainability.

-

Resource Advantage – Brazil and Iran leverage natural resources for cost-competitive steel, though logistics and politics differ.

Together, these countries provide resiliency and diversity in global steel supply, ensuring that no single nation holds all the power.

Conclusion

The global steel industry outside China and Russia is a dynamic ecosystem, balancing volume, technology, sustainability, and trade. India dominates in growth, the U.S. and EU innovate in green steel, Japan and Korea lead in quality, and emerging powers like Vietnam are reshaping Asia’s steel map.

For policymakers, businesses, and investors, understanding these top 10 producers is essential for strategic planning, supply chain resilience, and sustainability goals.

As of September 2025, this ranking underscores both the geopolitical balance and the industrial transformation underway in steel—a material as old as civilization but as critical as ever to the future.

Official Source

-

World Steel Association – World Steel in Figures 2025 (covers full-year 2024 data, published June 2025) 【worldsteel.org】

Latest News

-

Frequently Asked Questions

What quality assurance measures does Efreso have in place?

What is the typical lead time for sourcing steel through Efreso?

Can I request specific steel grades or specifications not listed on your website?

What information do I need to provide when requesting a quote?

How does Efreso help me find steel suppliers in Vietnam?

Other News

![How to Calculate EU Landed Cost for Steel (CN [72XXXXXX]): TARIC, TRQ & AD](/Data/ResizeImage/images/tintuc/landed_cost_eu_cn_xxxx_trq_taric_ad_cbam_update2x80x80x2.jpeg)

![How to Calculate EU Landed Cost for Steel (CN [72XXXXXX]): TARIC, TRQ & AD How to Calculate EU Landed Cost for Steel (CN [72XXXXXX]): TARIC, TRQ & AD](/Data/ResizeImage/images/tintuc/landed_cost_eu_cn_xxxx_trq_taric_ad_cbam_update2x500x250x1.jpeg)